2638 Accounting & Finance courses

Get a 10% discount on your first order when you use this promo code at checkout: MAY24BAN3X

Personal loan providers in Hyderabad at Finzway

By Finzway Pvt. Ltd

Finzway Financial Services is a dependable resource for people and companies looking for all-inclusive financial solutions. Our team of skilled experts is dedicated to provide individualized service and unique solutions that assist our clients in reaching their financial objectives.

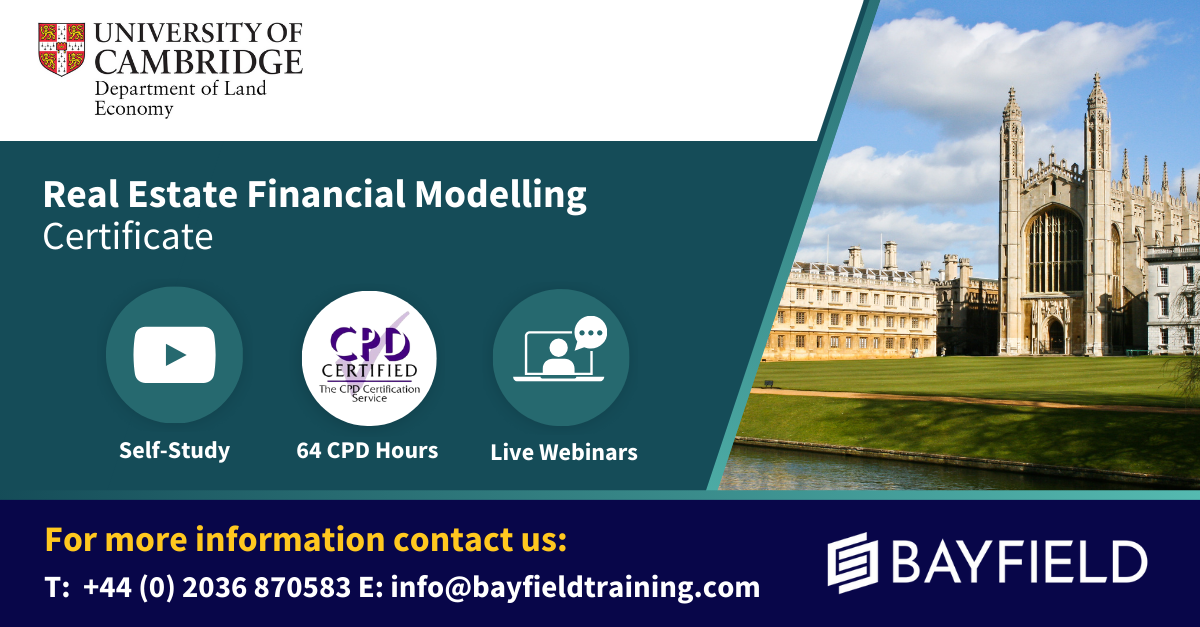

University of Cambridge & Bayfield Training - Real Estate Financial Modelling Certificate (Online Self-Study)

4.3(5)By Bayfield Training

Bayfield Training and the University of Cambridge Department of Land Economy This prestigious eight-week online Real Estate course is suitable for modellers new to Real Estate and experienced Real Estate Analysts looking to formalise their skill set. This course will equip you with skills to start building your own financial models and the certificate will give your employers and colleagues reassurance of your expertise. If you want to enhance your financial modelling skills over an extended period, the Real Estate Financial Modelling Certificate is the course for you. This online real estate course has been put together exclusively for the Real Estate Financial Modelling certificate, using state of the art digital resources such as animations, video-steps, digital whiteboard and video-interactions as well as the spreadsheets, text based resources and tutor contact you would expect from any of Bayfield Training’s classroom based courses. Assessment is in the form of a guided model build exercise and written model appraisal. Participants benefit from an additional months access to the course platform after submission of the assessment. ON THIS COURSE YOU WILL: * Become a competent model builder, building Real Estate Financial Models from scratch * Learn tricks and concepts from financial modelling experts with decades of experience in practice and academia * Learn how to use Real Estate Financial Models to make informed investment decisions * Learn at a consistent pace over 8 weeks allowing you to take the time to fully grasp this important skill THIS COURSE IS SUITABLE FOR: * Chartered Surveyors * Asset Managers * Financial Controllers * Financial Analysts * Investment Managers * Property Managers * Real Estate Students/Recent Graduates Course Outline: Module 1 - Economic Context Introduction to Real Estate Asset Modelling and how it relates to and is distinct from Econometric Models. * Introduction to Real Estate Asset Modelling and how it relates to and is distinct from Econometric Models. * Why Real Estate Asset Modelling is important * Understanding the occupier, asset and development markets and the relevant modelling approaches for each * Real Estate Sub-Sector Key Performance Indicators * Introduction to conventional valuations and financial mathematics * Understanding and minimising errors in Financial Models Module 2 - Cash Flow Fundamentals Constructing a financial model from first principles. * Understanding all the components of a basic cash flow model * Understand why Corporate Finance Models and Real Estate Models are different * Financial Model Design * Making the link between valuations, income mathematics and discounted cash flows * Internal Rate of Return, Net Present Value,Worth and other metrics * Features and techniques to aid fast model building Module 3 - Developing the Cash Flow Adapting financial models for different periodicities and building rent functions for different rent behaviour. * Understanding how leases vary with respect to rent over time: Rent Reviews, Break Clauses, Rent Free Periods, Lease Expiries etc. * Developing the concept of a Rent Function in Excel * Logic mathematics and Logic functions * Projecting rent to adapt to different lease contracts and growth patterns * Alternative solutions to Logic functions * Comparative analysis of lease structures in different jurisdictions and adapting financial models Module 4 - Real Estate Data Understanding the different sources of data, constructing basic time series models and recognising basic patterns. * Key Property market indicators * Characteristics and application of key input metrics for Real Estate Appraisals * Understanding the eight components of Real Estate Price Dynamics * Awareness of the different sources of data * Reading and using general property market reports * Constructing basic time series models and recognising basic patterns Module 5 - Development Appraisals Constructing a development appraisal from first principles and understanding development return metrics. * Understanding the key components of a development project * Understanding the difference between development and investment appraisals * Residual Appraisals and Profit Calculations * Cost orientated cash flows and phased sales * Cumulative construction cost patterns: incidental, fixed, loaded and S-curve * Development return metrics and Modified IRRs Module 6 - Multi-let Cash Flows Constructing an advanced multi-let cash flow model and learn different techniques to build flexible rent functions. * Multi-let and portfolio model design principles * Building complex date functions and date series * The three multi-let rent projection techniques * Perpendicular Rent Functions * Incorporate advanced rent adjustments into the Rent Function * Incorporate sector and period varying rental growth rates * Simplifying OPEX and CAPEX projections * Discounting techniques on complex and volatile cash flows Module 7 - Project Finance Constructing a flexible Real Estate Debt Finance model. * Revision of the Mathematics of amortisation and debt finance * Basic senior debt models and geared net cash flow * LTV, IRR and Interest Rate Dynamics * Flexible term, repayment options and deferred interest * Loan covenant tests * Understanding different tranches of debt * Understanding how complex debt structures impact the returns to different parties Module 8 - Model Interpretation and Risk Analysis Learn how to read, analyse and report on real estate financial models. * Understand how to read models and develop an investment narrative * Visualise model outputs using graph functions, conditional formatting, dynamic symbols and dashboards * Learn how to use built-in Sensitivity, Scenario Analysis tools and third-party add-ins * Learn how to construct varied project scenarios in a systematic way * Introduction to Monte Carlo Analysis and VBA * Optimising sale dates and other parameters * Create well written, attractive and persuasive reports Included in the Course * Bayfield Training and University of Cambridge Accredited Certificate & LinkedIn Proficiency Badge * 64 CPD Hours * 1 Month Post-Course Access to the Digital Platform - 12 Months Post-Course Access to the Platform can be purchased for an additional fee * Course Files * Q&A Webinars and Guest Speaker Webinars * Further Learning Resources (Reading, Files and Videos) * Post Course Support - Two Months of Questions & Answers 2024 Cohort Dates Include: * 3rd June to 29th July * 5th August to 25th September 2024 * 30th September to 25th November For more information, please contact Sam on the Bayfield Training Sales team: E - s.musgrave@bayfieldtraining.com T - 01223 517851 W - www.bayfieldtraining.com [https://www.bayfieldtraining.com/]

Access to Finance

By Let’s Do Business Group

Looking to bring your business growth ideas to life but need a cash injection? Join us at our FREE online webinar

ICA International Diploma in Governance, Risk and Compliance

By International Compliance Association

ICA INTERNATIONAL DIPLOMA IN GOVERNANCE, RISK AND COMPLIANCE New technologies are changing the role of a compliance professional. Fintech and Regtech are now embedded in compliance lexicon, but what do the terms mean, and what are the practical impacts, both positive and negative, that we need to understand and manage? The ICA International Diploma in Governance, Risk and Compliance helps you to answer these questions and apply the answers directly within your organisation. Gain a broad understanding of the regulatory environment as well as the specialist skills and knowledge to be able to identify and manage key regulatory risks today and in the future. * Get to grips with the nuances of the regulatory environment and the impact to your organisation. * Understand why promoting a positive compliance culture is not just good for compliance but good for business. * Explore how to maximise the benefits of emerging technologies. * Develop your inter-personal skills so you can be the best Compliance Manager. * Learn from the experiences of compliance professionals from other firms and sectors and share ideas. This governance, risk and compliance course is awarded in association with Alliance Manchester Business School, the University of Manchester. Benefits of studying with ICA: * Flexible learning solutions that are suited to you * Our learner-centric approach means that you will gain relevant practical and academic skills and knowledge that can be used in your current role * Improve your career options by undertaking a globally recognised qualification that hiring managers look for as part of their hiring criteria * Many students have stated that they have received a promotion and/or pay rise as a direct result of gaining their qualification * The qualifications ensure that you are enabled to develop strategies to help manage and prevent risk within your firm, thus making you an invaluable asset within the current climate Completion of this training course will provide participants with the following professional qualification: ICA Diploma in Governance, Risk and Compliance. In addition, participants will be entitled to use the following designation 'Dip (Comp).' These qualifications are awarded in association with Alliance Manchester Business School, the University of Manchester. What will you learn? * Understanding governance, risk and regulatory compliance * Why we need to understand the regulated environment * Why are governance and culture essential for effective regulatory compliance risk management? * The role of the compliance department and the compliance professional * Risk management as the key to effective compliance * Case Studies

Accounting & Finance Accounting and finance assist businesses in measuring, monitoring, and planning their operations. This Accounting & Finance course has been designed to provide a thorough introduction to business Accounting & Finance as both an idea and a profession. This Accounting & Finance course will equip you with in-demand accounting and finance skills as well as the ability to complete practicable processes while working in an organisation. This could be tricky, especially if this is your first consignment in the accounting & finance sector. Our Accounting & Finance course provides a solid understanding of accounting and financial methods, concepts, and duties to properly prepare you for a career in the accounting finance sector. Courses: * Accounting & Finance * Anti-Money Laundering (AML) Training * Diploma in Forex Trading Accounting & Finance Detailed Course Curriculum of this Accounting & Finance Course: * Module 1: Essentials of Accounting and Finance * Module 2: Types of Cost Data and Cost Analysis * Module 3: Contribution Analysis * Module 4: Break-Even and Cost-Volume-Profit Analysis * Module 5: Relevant Cost and Making Short-Term Decisions * Module 6: Forecasting Cash Needs and Budgeting * Module 7: Cost Control and Variance Analysis * Module 8: Managing Financial Assets * Module 9: Managing Accounts Receivable and Credit * Module 10: Managing Inventory * Module 11: The Time Value of Money * Module 12: Capital Budgeting Decisions * Module 13: Improving Managerial Performance * Module 14: Sources of Short-Term Financing * Module 15: Considering Term Loans and Leasing * Module 16: Long-Term Debt and Equity Financing * Module 17: Accounting Conventions and Recording Financial Data Assessment Method After completing each module of the Accounting and Finance course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Accounting and Finance course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. WHO IS THIS COURSE FOR? Accounting & Finance This Accounting and Finance course is ideal for: * Candidates interested to start a career in accountancy * Business owners seeking to look after their own accounts * Existing accountancy workers in seeking higher positions or promotion * Accountancy workers with no formal qualifications * Anyone wishing to boost their career prospects. REQUIREMENTS Accounting & Finance There are no specific requirements for this Accounting and Finance Course because it does not require any advanced knowledge or skills. Students who intend to enrol in this Accounting Finance Course must meet the following requirements: * Accounting Finance : Good command of the English language * Accounting Finance : Must be vivacious and self-driven * Minimum Basic computer knowledge * A minimum of 16 years of age is required CERTIFICATES CERTIFICATE OF COMPLETION Digital certificate - Included

Accounting & Finance Course

By Training Tale

Accounting & Finance Accounting and finance assist businesses in measuring, monitoring, and planning their operations. This Accounting & Finance course has been designed to provide a thorough introduction to business Accounting & Finance as both an idea and a profession. This Accounting & Finance course will equip you with in-demand accounting and finance skills as well as the ability to complete practicable processes while working in an organisation. This could be tricky, especially if this is your first consignment in the accounting & finance sector. Our Accounting & Finance course provides a solid understanding of accounting and financial methods, concepts, and duties to properly prepare you for a career in the accounting finance sector. Courses: * Accounting & Finance * Anti-Money Laundering (AML) Training * Diploma in Forex Trading Accounting & Finance Detailed Course Curriculum of this Accounting & Finance Course: * Module 1: Essentials of Accounting and Finance * Module 2: Types of Cost Data and Cost Analysis * Module 3: Contribution Analysis * Module 4: Break-Even and Cost-Volume-Profit Analysis * Module 5: Relevant Cost and Making Short-Term Decisions * Module 6: Forecasting Cash Needs and Budgeting * Module 7: Cost Control and Variance Analysis * Module 8: Managing Financial Assets * Module 9: Managing Accounts Receivable and Credit * Module 10: Managing Inventory * Module 11: The Time Value of Money * Module 12: Capital Budgeting Decisions * Module 13: Improving Managerial Performance * Module 14: Sources of Short-Term Financing * Module 15: Considering Term Loans and Leasing * Module 16: Long-Term Debt and Equity Financing * Module 17: Accounting Conventions and Recording Financial Data Assessment Method After completing each module of the Accounting and Finance course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Accounting and Finance course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. WHO IS THIS COURSE FOR? Accounting & Finance This Accounting and Finance course is ideal for: * Candidates interested to start a career in accountancy * Business owners seeking to look after their own accounts * Existing accountancy workers in seeking higher positions or promotion * Accountancy workers with no formal qualifications * Anyone wishing to boost their career prospects. REQUIREMENTS Accounting & Finance There are no specific requirements for this Accounting and Finance Course because it does not require any advanced knowledge or skills. Students who intend to enrol in this Accounting Finance Course must meet the following requirements: * Accounting Finance : Good command of the English language * Accounting Finance : Must be vivacious and self-driven * Minimum Basic computer knowledge * A minimum of 16 years of age is required CERTIFICATES CERTIFICATE OF COMPLETION Digital certificate - Included

Accounting, Finance and Payroll Management Online Training Bundle

By Lead Academy

8 CPD UK & IPHM Accredited Courses Bundle | Recognised Certificate | MCQ based Exam and Tutor Support Included | Lifetime Access | Instant Result | Interactive Video Training Are you looking to begin your xero accounting, finance and payroll management career or want to develop more advanced skills in xero accounting, finance and payroll management? Then this accounting, finance and payroll management course will set you up with a solid foundation to become a confident xero accountant, financial analyst and payroll manager and help you to develop your expertise in xero accounting, finance and payroll management. This bundle course has been designed with 8 CPD UK & IPHM accredited courses to provide the ultimate learning experience for our learners to further develop their expertise in their chosen field. Gain the essentials skills and knowledge you need to propel your career forward as a xero accountant, financial analyst and payroll manager. This Bundle Package Includes: The following courses of the accounting, finance and payroll management course will set you up with a solid foundation in the xero accounting, finance and payroll management industry and give you the essential skills you need to succeed! * Xero Basic Skills Course * Xero Advanced Course * Payroll Administrator Training * Business Accounting and Finance * Financial Analyst * Accounting Level 1 & 2 * Creative Accountant * Interview Skills for Accountants If you're interested in working as a xero accountant, financial analyst and payroll manager or want to learn more skills in xero accounting, finance and payroll management but unsure of where to start, then this accounting, finance and payroll management course will set you up with a solid foundation to become a confident xero accountant, financial analyst and payroll manager and develop more advanced skills. The accounting, finance and payroll management course will set you up with the appropriate skills and experience needed for the job and is ideal for both beginners and those currently working as a xero accountant, financial analyst and payroll manager. The accounting, finance and payroll management courses bundle will help learners to fully enhance their skill set in team leading and active monitoring. By combining these related courses, learners will be equipped with a wide range of desirable skills to fast track their career. This comprehensive accounting, finance and payroll management course is the perfect way to kickstart your career in the field of xero accounting, finance and payroll management. This accounting, finance and payroll management course will give you a competitive advantage in your career, making you stand out from all other applicants and employees. This accounting, finance and payroll management course supports learners of all skill levels. Whether you're an intermediate or advanced learner looking to brush up on your skills or a beginner wanting to start a new career or learn something new, our dedicated team of expert tutors are on hand to guide you through your learning every step of the way from enrolment to course completion. As one of the leading course providers and most renowned e-learning specialists online, we're dedicated to giving you the best educational experience possible. This accounting, finance and payroll management course is crafted by industry expert, to enable you to learn quickly and efficiently, and at your own pace and convenience. WHY CHOOSE THIS ACCOUNTING, FINANCE AND PAYROLL MANAGEMENT COURSE: * 8 Courses Bundle in your desired field * Boost your skills in xero accounting, finance and payroll management * Endorsed by The Quality Licence Scheme * Accredited by The CPD UK and International Practitioners of Holistic Medicine (IPHM) * MCQ Based Exam & Industry Expert Support Included * Dual (CPD UK and IPHM) recognised accredited certificate in 1 course * Learn from industry experts * Lifetime Access * High-quality e-learning study materials * Self-paced, no fixed schedules * 24/7 customer support through email * Available to students anywhere in the world * Study in a user-friendly, advanced online learning platform WHY CHOOSE THIS ACCOUNTING, FINANCE AND PAYROLL MANAGEMENT COURSE: This comprehensive accounting, finance and payroll management bundle course are suitable for anyone looking to improve their job prospects or aspiring to accelerate their career in this sector and want to gain in-depth knowledge of xero accounting, finance and payroll management. ENTRY REQUIREMENT * There are no academic entry requirements for this course, and it is open to students of all academic backgrounds. COURSE CURRICULUM Xero Basic Skills Course Xero Advanced Course Payroll Administrator Training Business Accounting and Finance Financial Analyst Accounting Level 1 & 2 Creative Accountant Interview Skills for Accountants RECOGNISED ACCREDITATION CPD CERTIFICATION SERVICE This course is accredited by continuing professional development (CPD). CPD UK is globally recognised by employers, professional organisations, and academic institutions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. CPD certificates are accepted by thousands of professional bodies and government regulators here in the UK and around the world. Many organisations look for employees with CPD requirements, which means, that by doing this course, you would be a potential candidate in your respective field. QUALITY LICENCE SCHEME ENDORSED The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. It will give you a competitive advantage in your career, making you stand out from all other applicants and employees. CERTIFICATE OF ACHIEVEMENT ENDORSED CERTIFICATE FROM QUALITY LICENCE SCHEME After successfully passing the MCQ exam you will be eligible to obtain the Endorsed Certificate by Quality Licence Scheme. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organization for providing high-quality vocational qualifications across a wide range of industries. It will give you a competitive advantage in your career, making you stand out from all other applicants and employees. There is a Quality Licence Scheme endorsement fee to obtain an endorsed certificate which is £65 and will be charged separately for each course. CERTIFICATE OF ACHIEVEMENT FROM LEAD ACADEMY After successfully passing the MCQ exam, you will be eligible to order your certificate of achievement as proof of your new skill. The certificate of achievement is an official credential that confirms that you successfully finished a course with Lead Academy. You/your employer can verify your certificate through our website. Certificate can be obtained in PDF version and will be charged separately for each course, at a cost of £12, and there is an additional fee to obtain a printed copy certificate which is £35. FAQS IS CPD A RECOGNISED QUALIFICATION IN THE UK? CPD is globally recognised by employers, professional organisations and academic intuitions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. CPD-certified certificates are accepted by thousands of professional bodies and government regulators here in the UK and around the world. ARE QLS COURSES RECOGNISED? Although QLS courses are not subject to Ofqual regulation, they must adhere to an extremely high level that is set and regulated independently across the globe. A course that has been approved by the Quality Licence Scheme simply indicates that it has been examined and evaluated in terms of quality and fulfils the predetermined quality standards. WHEN WILL I RECEIVE MY CERTIFICATE? For CPD accredited PDF certificate it will take 24 hours, however for the hardcopy CPD certificate takes 5-7 business days and for the Quality License Scheme certificate it will take 7-9 business days. CAN I PAY BY INVOICE? Yes, you can pay via Invoice or Purchase Order, please contact us at info@lead-academy.org for invoice payment. CAN I PAY VIA INSTALMENT? Yes, you can pay via instalments at checkout. HOW TO TAKE ONLINE CLASSES FROM HOME? Our platform provides easy and comfortable access for all learners; all you need is a stable internet connection and a device such as a laptop, desktop PC, tablet, or mobile phone. The learning site is accessible 24/7, allowing you to take the course at your own pace while relaxing in the privacy of your home or workplace. DOES AGE MATTER IN ONLINE LEARNING? No, there is no age limit for online learning. Online learning is accessible to people of all ages and requires no age-specific criteria to pursue a course of interest. As opposed to degrees pursued at university, online courses are designed to break the barriers of age limitation that aim to limit the learner's ability to learn new things, diversify their skills, and expand their horizons. WHEN I WILL GET THE LOGIN DETAILS FOR MY COURSE? After successfully purchasing the course, you will receive an email within 24 hours with the login details of your course. Kindly check your inbox, junk or spam folder, or you can contact our client success team via info@lead-academy.org

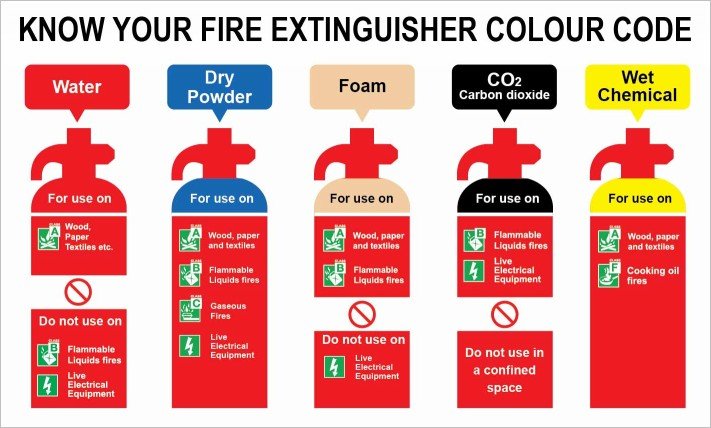

The Level 2 Award in Fire Safety is aimed at anyone who is involved in the management of fire safety or fire prevention in the workplace. This includes managers, supervisors, team leaders and fire marshals (or wardens).

Accounting, Finance and Banking - A Comprehensive Study

By Apex Learning

Tired of searching and accumulating all the relevant courses for this specific field? It takes a substantial amount of your time and, more importantly, costs you a fortune! Well, we have just come up with the ultimate solution for you by giving this all-inclusive Accounting, Finance and Banking mega bundle. This 40 courses mega bundle keeps you up-to-date in this field and takes you one step ahead of others. Keeping in mind the latest advancements in this ever-emerging sector, the Accounting, Finance and Banking bundle covers all the state-of-the-art tools and techniques required to become a competent worker in this area. You will encounter specific courses relevant to the sector. We take you from the most introductory fundamentals to advance knowledge in a step-by-step manner. In addition, the Accounting, Finance and Banking bundle also consists of courses related to some soft skills that you will need to succeed in any industry or job sector. This Accounting, Finance and Banking Bundle consists of the following premium courses: * Course 01: Accounting and Finance Certification Course * Course 02: Accounting Skills for New Supervisors * Course 03: Changes in Accounting: Latest Trends Encountered by CFOs in 2022 * Course 04: Xero Accounting Diploma * Course 05: Managerial Accounting Masterclass * Course 06: Charity Accounting * Course 07: Key Account Management for Beginners * Course 08: Pensions Training * Course 09: Tax Accounting * Course 10: Improve your Financial Intelligence * Course 11: Fundamentals of Corporate Finance * Course 12: SAP S4HANA Controlling Course - Cost Center Accounting * Course 13: Capital Budgeting & Investment Decision Training * Course 14: Financial Analysis * Course 15: Accountancy Basics * Course 16: Accounting Interview Skills * Course 17: Banking and Finance Accounting Statements Financial Analysis * Course 18: Raise Money and Valuation for Business * Course 19: Investment Banking Training Course * Course 20: Managing Budgets * Course 21: Learn How to Finance and Grow Your Startup * Course 22: Understanding Financial Statements and Analysis * Course 23: Stock Market Investment * Course 24: Diploma in Forex Trading * Course 25: Financial Business Analysis * Course 26: Financial Advisor * Course 27: Finance and Cash management for Hospitality * Course 28: Anti-Money Laundering (AML) Training * Course 29: Microsoft Excel Complete Training * Course 30: Office Skills Moreover, this bundles include 10 career-focused courses: * Course 01: Career Development Plan Fundamentals * Course 02: CV Writing and Job Searching * Course 03: Interview Skills: Ace the Interview * Course 04: Video Job Interview for Job Seekers * Course 05: Create a Professional LinkedIn Profile * Course 06: Business English Perfection Course * Course 07: Networking Skills for Personal Success * Course 08: Boost Your Confidence and Self-Esteem * Course 09: Public Speaking Training * Course 10: Learn to Fight Procrastination Our cutting-edge learning package offers top-notch digital aid and first-rate tutor support. You will acquire the crucial hard and soft skills needed for career advancement because this bundle has been thoroughly examined and is career-friendly. So don't overthink! Enrol today. Learning Outcomes This unique Accounting, Finance and Banking mega bundle will help you to- * Quench your thirst for knowledge * Be up-to-date about the latest advancements * Achieve your dream career goal in this sector * Know the applicable rules and regulations needed for a professional in this area * Acquire some valuable knowledge related to Accounting, Finance and Banking to uplift your morale The bundle incorporates basic to advanced level skills to shed some light on your way and boost your career. Hence, you can strengthen your expertise and essential knowledge, which will assist you in reaching your goal. Moreover, you can learn from any place in your own time without travelling for classes. Certificate: * PDF Certificate: Free for all 40 courses * Hard Copy Certificate: Free (For The Title Course: Previously it was £10) CPD 400 CPD hours / points Accredited by CPD Quality Standards WHO IS THIS COURSE FOR? The Accounting, Finance and Banking bundle is designed to assist anyone with a curious mind, anyone looking to boost their CVs or individuals looking to upgrade their career to the next level can also benefit from the learning materials. REQUIREMENTS The courses in this bundle has been designed to be fully compatible with tablets and smartphones. CAREER PATH This Accounting, Finance and Banking bundle will give you an edge over other competitors and will open the doors for you to a plethora of career opportunities. CERTIFICATES CERTIFICATE OF COMPLETION Digital certificate - Included CERTIFICATE OF COMPLETION Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Accounting and Finance Certification Course) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

Educators matching "Accounting & Finance"

Show all 3032Search By Location

- Accounting & Finance Courses in London

- Accounting & Finance Courses in Birmingham

- Accounting & Finance Courses in Glasgow

- Accounting & Finance Courses in Liverpool

- Accounting & Finance Courses in Bristol

- Accounting & Finance Courses in Manchester

- Accounting & Finance Courses in Sheffield

- Accounting & Finance Courses in Leeds

- Accounting & Finance Courses in Edinburgh

- Accounting & Finance Courses in Leicester

- Accounting & Finance Courses in Coventry

- Accounting & Finance Courses in Bradford

- Accounting & Finance Courses in Cardiff

- Accounting & Finance Courses in Belfast

- Accounting & Finance Courses in Nottingham